Federal Budget 2023-2024

Summary overview

Here are the key tax and super takeaways from the Budget. Further information can be found in Thomson Reuters Federal Budget 2023 report.

What it means for Individuals

The Labor Government has announced a slender surplus, the first in more than a decade, and a range of measures primarily aimed at lowering the cost of living or improving welfare for those in difficult circumstances.

Personal taxation

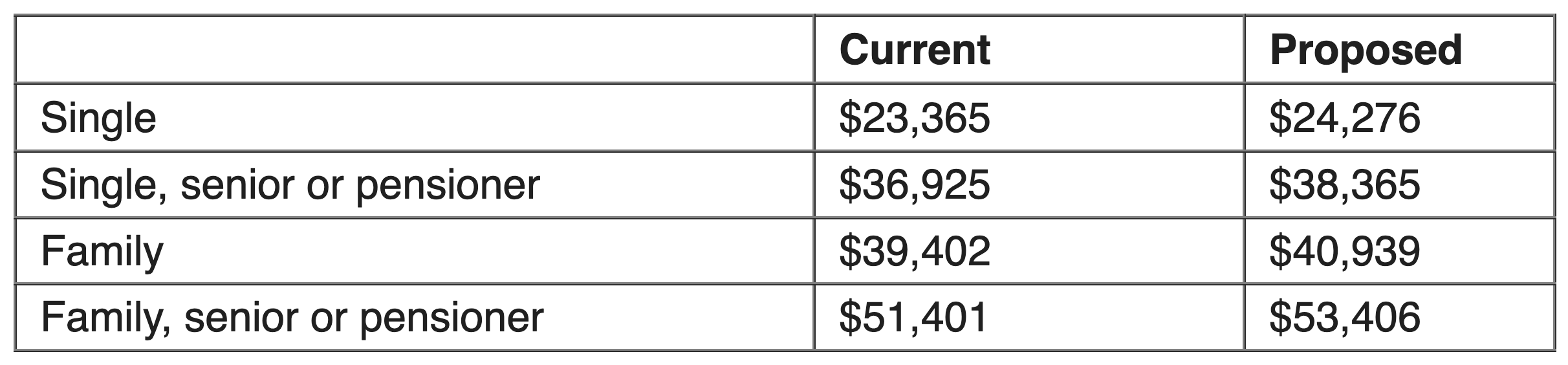

No changes were announced to personal taxation apart from the annual indexation of the Medicare Levy threshold, which ensures that low income individuals continue to be exempt from paying the Medicare levy. This takes the family threshold above $40,000 for the first time, to $40,939 plus $3,760 for each dependent child, and the seniors threshold to $53,406, while the single threshold increases to $24,276.

The 2023-24 Budget did not announce any extension of the low and middle income tax offset (LMITO) beyond the 2021-22 income year. The LMITO has now ceased and been fully replaced by the low income tax offset (LITO). As a result, low-mid income earners may see their tax refunds from July 2023 reduced by between $675 and $1500 (for incomes up to $90,000 but phasing out up to $126,000), all other things being equal.

Cost of Living Measures

As previously announced, low income households will receive relief in the form of a deduction of up to $500 from their power bills from 1 July 2023. Eligible small businesses will receive a deduction of up to $650.

Those on JobSeeker will receive an increase in their payments of $40 a fortnight from 20 September this year, while those over 55 on JobSeeker will receive an increase of $92.10 a fortnight, which is currently reserved for those over 60.

Also in September, eligible single parents will receive the single rate of Parenting Payment until their youngest child turns 14, which is currently only available until that child is 8 years old. The current base rate of Parenting Payment (Single) is $922.10 per fortnight, compared to the JobSeeker Payment base rate of $745.20 per fortnight.

Single parents moving to Parenting Payment (Single) will also benefit from more generous earning arrangements compared to JobSeeker. Eligible single parents with one child will be able to earn an extra $569.10 per fortnight, plus an extra $24.60 per additional child, before their payment stops.

The maximum rates of Commonwealth Rent Assistance will also increase by 15 per cent, a measure that will assist a wide range of social security recipients.

Home Ownership

As previously announced, eligibility for the First Home Guarantee and Regional First Home Guarantee will be expanded to any two eligible borrowers beyond married and de facto couples, and non-first home buyers who have not owned a property in Australia in the preceding 10 years. Australian Permanent Residents, in addition to Australian citizens, will also be eligible for the Home Guarantee Scheme. This is the scheme that allows aspiring home owners to buy a home with a deposit as low as 5% without paying lenders mortgage insurance.

For existing homeowners, an extensive range of energy saving initiatives such as electrification, energy saving appliances and solar panels will be eligible for low rate loans.

Family Support

From 1 July this year, Parental Leave Pay and Dad and Partner Pay will combine into a single 20-week payment. A new family income test of $350,000 per annum will see nearly 3,000 additional parents become eligible for the entitlement each year. The Government has also committed to increase Paid Parental Leave to 26 weeks by 2026.

Superannuation

At the other end of the scale, very high superannuation balances will attract a higher rate of tax from 1 July 2025. Earnings on balances exceeding $3 million will pay tax on earnings at a rate of 30 per cent, 15% higher than the current rate of 15%. Earnings on balances below $3 million will continue to be taxed at the concessional rate of 15 per cent. Defined benefit interests will be appropriately valued and will have earnings taxed under this measure in a similar way to other interests to ensure commensurate treatment.

Also in superannuation, employers will be required to pay superannuation contributions at the same time as wages from 1 July 2026, in a measure designed to increase compliance with superannuation legislation.

Investing Considerations

For investors, the two big categories were interestingly those also getting attention offshore – huge investments in renewable energy and decarbonisation, and the implementation of a global and domestic minimum tax rate of 15%, which has been an OECD focus to reduce incentives for international tax arbitrage.

It’s worth noting that all these measures will need to be drafted and passed through both houses of Parliament before taking effect.

Business Analysis from Business NSW

The Budget delivers a surprise small surplus for 2022-23 – the first in 15 years – ahead of a challenging 2023-24, which is predicted to see GDP growth halving to just 1.5% and unemployment rising. Nevertheless, real wage growth is expected to return in 2023-24, as inflation finally comes under control.

Tax

Instant asset write-off: Instant asset write-off threshold of $20,000 from 1 July 2023 until 30 June 2024. Small businesses, with aggregated annual turnover of less than $10 million, will be able to immediately deduct the full cost of eligible assets costing less than $20,000 that are first used or installed ready for use between 1 July 2023 and 30 June 2024. The $20,000 threshold will apply on a per asset basis, so small businesses can instantly write off multiple assets. This measure is estimated to decrease receipts by $290.0 million over the 5 years from 2022–23.

Tax compliance: A 15 per cent global and domestic minimum tax for large multinational companies, estimated to increase Australian tax receipts by $370 million over the 5 years from 2022–23.

GST Compliance: Extending GST tax compliance programs for a further four-year period; this is expected to increase GST receipts by $809.4 million in 2023–24 and $3.8 billion over the 5 years from 2022–23 to 2026–27.

Business Measures

Payday Superannuation: From 1 July 2026, a harmonising of payment of salary and superannuation, focused on boosting retirement savings and reducing the risk of unpaid superannuation.

Cyber security: $23.4 million over 3 years from 2023–24 for a small business cyber wardens program delivered by the Council of Small Business Organisations Australia, to support small businesses to build in-house capability to protect against cyber threats.

Industry Growth Program: The Government will provide $431.9 million over 4 years from 2023–24 (and $79.2 million per year ongoing) to improve support for small to medium enterprises (SMEs) and start-ups. Funding includes:

- $392.4 million over 4 years from 2023–24 (and $68.2 million per year ongoing) to establish the Industry Growth Program to support Australian SMEs and start-ups to commercialise their ideas and grow their operations. Support will be targeted towards businesses operating in the priority areas of the National Reconstruction Fund

- $39.6 million over 4 years from 2023–24 (and $11.0 million per year ongoing) to continue the Single Business Service, supporting SMEs engagement with all levels of government. This measure repurposes and expands funding that was previously delivered through the Entrepreneurs’ Programme.Growing Australia’s Critical Technology Industries: $101.2 million over 5 years to support businesses to integrate quantum and AI technologies into their operations

Small business compliance: The Government will provide $21.8 million over 4 years from 2023–24 (and $1.4 million per year ongoing) to the Australian Taxation Office (ATO) to lower the tax-related administrative burden for small businesses. The measure also delivers reforms to cut paperwork and reduce the time small businesses spend doing taxes:

Tax agents: from 1 July 2024, small businesses will be permitted to authorise their tax agent to lodge multiple Single Touch Payroll forms on their behalf, reducing paperwork for small businesses

Tax lodgement: from 1 July 2025, small businesses will be permitted up to 4 years to amend their income tax returns, reducing the burden of making revisions.

Cost of Living Relief

Energy bill discounts: $3 billion in state and federal funding for one-off energy bill discounts. Rebates as high as $500 for low-income households and estimated $630 rebates for NSW small businesses.

Commonwealth Rent assistance: Increase in Commonwealth Rent assistance by 15%, costing $2.7 billion over 5 years from 2022-23.

Aged care workers: $11.3 billion package to pay aged care workers an extra 15 per cent.

Household Energy upgrade fund: $1.3 billion to provide concessional finance to support home upgrades that reduce energy usage.

Single-parent payment: $1.9 billion to increase the eligibility of the single-parent payment, extending the eligibility until the youngest child is 14 years old. With eligible single parents currently on JobSeeker to receive an increase to payments of $176.90 per fortnight.

Welfare payments: $4.9 billion to increase the rate of JobSeeker, Austudy, and Youth Allowance by $40 per fortnight.

Pharmaceuticals: $2.2 billion to add new medicines to PBS listings and from September, doubling the maximum dispensing quantity.

Jobs, skills and migration

Migration Program: For the 2023–24 permanent Migration Program, the Government will return the planning level to the longer-term level of 190,000 places. However, it will allocate 137,100 of those places (around 70 per cent) to the Skill stream. (In 2021-22, the Skill stream was around 63 per cent of total visas).

Visa costs: The cost to apply for many visas will rise by 6 percentage points, meaning it will cost more to apply for already expensive temporary and permanent visas. For some visas, such as working holiday maker and tourist visas, application fees will increase by 21 percentage points.

PALM scheme: $370.8 million across four years to expand the Pacific Australia Labour Mobility Scheme, which provides working visas for people from Pacific countries.

International students: International students working in the aged care sector will be exempt from the 48 hour per fortnight work limit until 31 December 2023.

Visa processing: $75.8 million over two years from 2023–24 to extend the current surge in visa processing resources to improve timeliness of visa processing.

National Skills Agreement: The Government will provide $5.5 million in 2023–24 to continue supporting negotiations on a long-term skills funding agreement with the states and territories. Subject to the outcome of these negotiations, the Government has also retained $3.7 billion in the Contingency Reserve for a 5-year National Skills Agreement that will commence on 1 January 2024.

Age Pension Work Bonus: A further extension until 31 December 2023 to the age and veterans’ pensioners increase of the Work Bonus income bank.

Skills Assessment Pilot: The Government is re‑scoping 2 Skills Assessment Pilots to provide onshore migrants with fast‑tracked skills assessments, free employability assessments, and access to further training to improve their employment prospects.

Mutual Recognition: A mechanism for the Mutual Recognition of Qualifications will ensure students from India and Australia will have greater certainty that the qualifications they attain will be recognised by both countries.

Local Jobs Program: The Government will enhance the Local Jobs Program to support transformation to a net zero economy. New place-based flexible funding pools will be created to connect workers and communities with new jobs and skills opportunities, and four employment regions will receive additional on-the-ground resources to plan for and optimise the opportunities for economic transformation.

Housing

Commonwealth Rent Assistance Increase: 15% increase over 5 years from 2022–23 to Commonwealth Rent Assistance at a cost of $2.7 billion.

Social and affordable housing: A number of housing measures to increase support for social and affordable housing across the country and improve access for home buyers, including amending NHFIC’s Investment Mandate to require NHFIC to take reasonable steps to allocate a minimum of 1,200 homes to be delivered in each state and territory within 5 years of the Housing Australia Future Fund commencing operation

Accelerated tax deductions to encourage build-to-rent: For eligible new build-to-rent projects where construction commences after 7:30 PM (AEST) on 9 May 2023 (Budget night), the Government will: increase the rate for the capital works tax deduction (depreciation) to 4 per cent per year and reduce the final withholding tax rate on eligible fund payments from managed investment trust (MIT) investments from 30 per cent to 15 per cent.

Infrastructure

Review of Infrastructure Investment Program: The Government will undertake an independent strategic review of the Infrastructure Investment Program (IIP) to ensure the $120.0 billion pipeline over 10 years is fit for purpose and the Government’s investment is focused on projects which improve long-term productivity, supply chains and economic growth in our cities and regions. Updated IIP project schedules will be finalised following the review, with Government working with states and territories to determine priorities.

NSW Roads Upgrades: $361.9 million over 8 years from 2023–24 for infrastructure projects in New South Wales, including safety upgrades on the Bells Line of Road and Nowra Bypass planning.

Parkes Intermodal: $3.0 million in 2023–24 to undertake a feasibility study for an intermodal terminal in Parkes, New South Wales to support the Inland Rail program, with funding to be redirected from existing National Intermodal Corporation equity.

Sydney Harbour Federation Trust: $45.2 million over two years from 2023–24 to continue the renewal and repair of heritage-listed infrastructure and undertake public safety improvements at North Head Sanctuary and Cockatoo Island.

Energy

Tax deduction for energy upgrades: Tax deduction of up to $20,000 for eligible small and medium sized businesses (turnover <$50 million) investing in energy efficient equipment or electrification of cooling and heating systems. Up to 3.8 million small businesses will be eligible. Eligible assets or upgrades will need to be first used or installed between 1 July 2023 and 30 June 2024. (Full details of eligibility criteria will be finalised after consultation with stakeholders.)

Reform of Petroleum Resource Rent Tax: Capping deductions under PRRT at 90% of revenue. Estimated to raise an additional $2.4 billion from offshore oil and gas producers over the 5 years from 2022-23.

Creation of National Net Zero Authority: The Authority will have responsibility for promoting the orderly and positive economic transformation associated with achieving net zero emissions, such as assisting impacted workers in emissions-intensive industries.

Capacity Investment Scheme: The Government will establish the Capacity Investment Scheme to underwrite new investment in clean energy, accelerating the development of cheap, clean renewable generation and storage and ensuring the smooth transformation of Australia’s energy market. Projects initially to be delivered in Victoria and South Australia, with the Commonwealth to identify projects in NSW in partnership with the NSW Electricity Infrastructure Roadmap.

Hydrogen Headstart: $2 billion to accelerate development of hydrogen industry.

Federal Budget Insights Report 2023-24

Thomson Reuters '2023 Federal Budget Report', download the full report here -

Full budget papers

For further details on the Federal Budget proposals, access the full budget papers at www.budget.gov.au

Image: Bush & Campbell Directors, David Rosetta, Rebecca Nicoll, Daniel Uden, Mathew Smith, Sharon Ferguson, Amanda Powell and Peter King

We’re here to help!

If you have any questions or concerns, or would like further information, please do not hesitate to get in touch with our team of Bush & Campbell experts.